Kiriakos Krastillis's Blog

Cardano Staking Myth #2: Luck & High ROI

There are some misconceptions around staking and stake pool performance. In this post I try to shine light on two of them

Misconception #1: High pool luck increases ROI %

Actually this means exactly the opposite. As already known, ROI in Ada staking is defined by the Cardano protocol. If your pool is being run professionally you should get around 5.6% annual return (5.9% in the theoretical best case).

Now if you see a pool on adapools.org that has a calculated luck of over 100% or a ROI of over over 5.6% this means that this pool has gotten lucky in the past. What you need to keep in mind is that block allocation is calculated based on statistics and those statistics mean that, since the pool has gotten more than its share in the past, the future will hold less than optimal results for this pool. So if you are looking to delegate to a pool, your best bet is to find a pool with low luck and matching ROI.

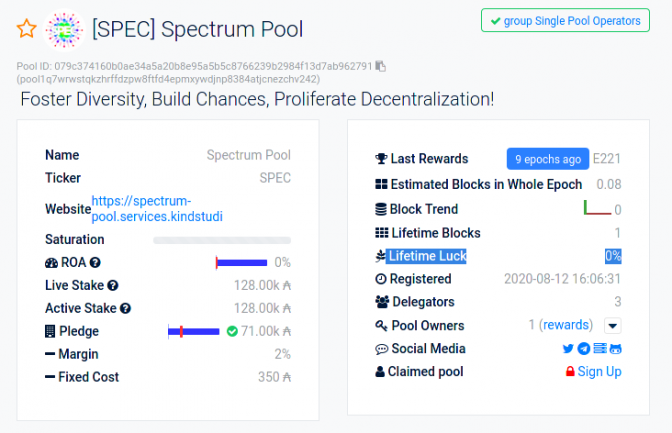

Adapools.org will show you lifetime luck % but not lifetime ROI % so just go with that as an indicator.

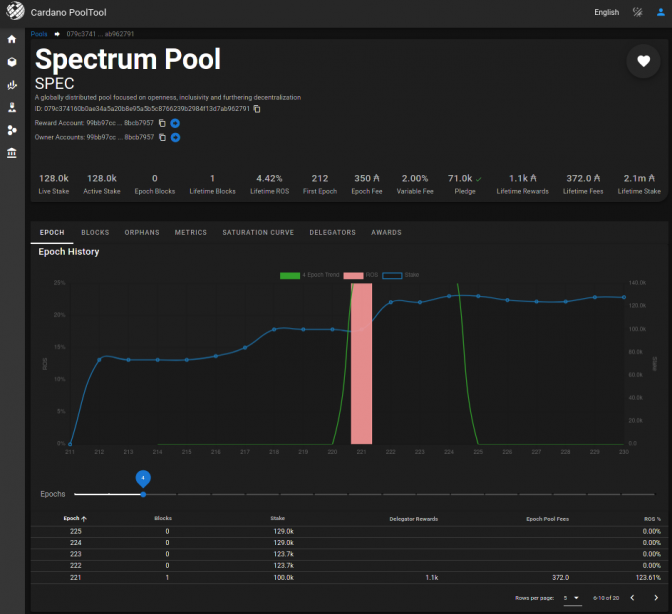

Pooltool.io shows lifetime ROI % but not lifetime luck % so best start looking at pools on adapools.org and then cross check on pooltool.io to see if the lifetime ROI fits the bill.

What you want to see is something like this:

| Luck | min ROI | | 80% | ~4.5% | | 40% | ~2% | ... etc.

So if a pool has 80% luck, its ROI should at least be around the 4.5% mark. If it is below that, it means the pool is missing blocks for one reason or the other (offline, KES key expired etc).

So lets see how SPEC holds up

Here we see a pool with 0% luck but 4.4% lifetime ROI. Pools with little delegation will

sometimes have a very low luck rating because they produce a block now and then. SPEC needs

to get one block every 14 Epochs to get to the ideal 5.9% ROI.

Here we see a pool with 0% luck but 4.4% lifetime ROI. Pools with little delegation will

sometimes have a very low luck rating because they produce a block now and then. SPEC needs

to get one block every 14 Epochs to get to the ideal 5.9% ROI.

Misconception #2: Low stake = bad ROI %

This is just incorrect. The protocol makes sure every stake pool gets the amount of blocks they need to reach max ROI, regardless of their saturation level. The only difference is that, since each block has a specific value in the rewards calculation, a small pool will only need one or two blocks to get their fair share of rewards.

Lets say we have a Cardano network with 1.000.000 ADA staked between just two pools. Lets also say our Cardano testnet gives 5% per period and that the period is 10.000 blocks. The stake distribution is:

Pool A with 10.000 Ada

Pool B with 990.000 Ada

Now 5% of 1.000.000 Ada is 50.000 Ada. If the period has 10.000 Blocks it means that each block creates 5 Ada. Now, to reach their 5% ROI goal both pools will need blocks.

Pool A will need 10.000 * 0.05 / 5 = 100 Blocks.

Pool B will need 990.000 * 0.05 / 5 = 9900 Blocks.

So we see that Pool A gets to their goal with much less effort since they only need to create 100 Blocks. In the real world we see that very small pools might only need 3 or 4 blocks per year to reach their 5.9% ROI target. This means that those pools will only be making blocks from time to time. SPEC only makes a block every 14 or so epochs, but when it does our delegators get 1.3% ROI each block!!

So don't be afraid to delegate to small pools. Do it, and stick around for a year or longer. The fun fact is, if your pool really gets lucky you will get significantly more than 5.6% percent out of it (and then you should delegate to another pool since your current one will start underperforming now)!

Cheers, k